价格: ¥ 4580.00

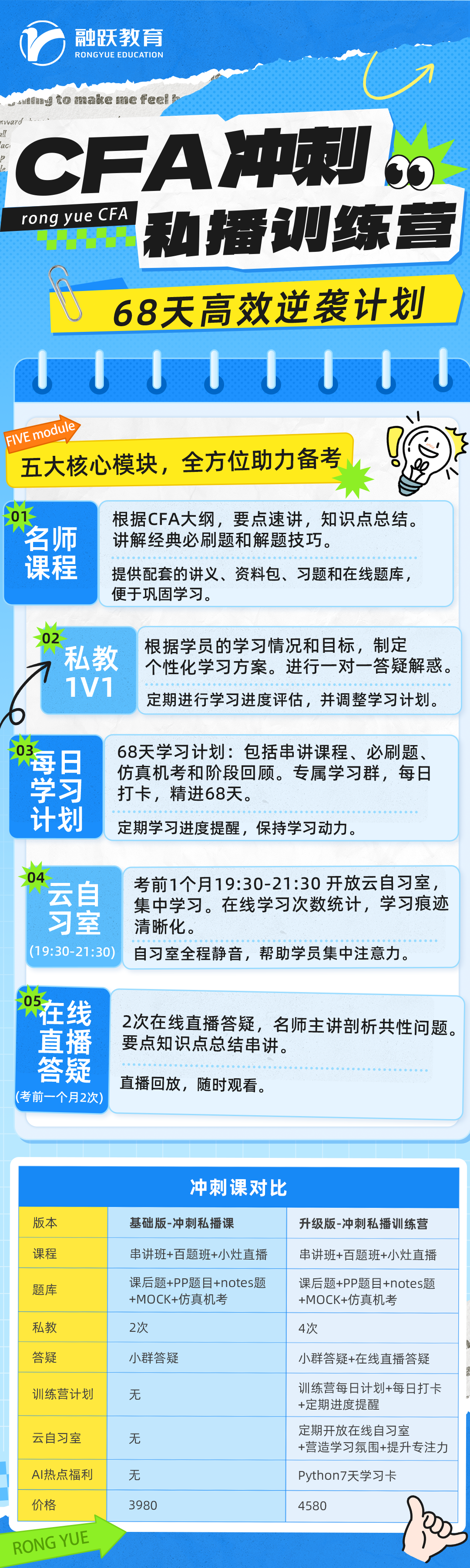

CFA 冲刺私播训练营-68 天高效逆袭计划

五大核心模块,全方位助力备考:

1.名师课程:

根据CFA大纲,要点速讲,知识点总结。

讲解经典必刷题和解题技巧。

提供配套的讲义、资料包、习题和在线题库,便于巩固学习。

2. 私教 1V1

根据学员的学习情况和目标,制定个性化学习方案。

视频有效期:3个月

视频时长:约62小时

详情介绍

课程大纲

{in name="user_id" value="21644"} {/ in}课程试听 推荐

1.Ethical and Professional Standards

Module 1 Ethics and Trust in the Investment Profession

![]()

Module 2 Code of Ethics and Standards of Professional Conduct

![]()

Module 3 Guidance for Standards I–VII

![]()

Module 4 Introduction to the Global Investment Performance Standards (GIPS)

![]()

2.Portfolio Management

Module 1 Portfolio Risk and Return

![]()

Module 2 Basic of Portfolio Management

![]()

Module 3 The Behavioral Biases of Individuals

![]()

Module 4 Introduction to Risk Management

![]()

3.Alternative Investments

Module 1 Alternative Investment Features, Methods, and Structures

![]()

Module 2 Alternative Investment Performance and Returns

![]()

Module 3 Investments in Private Capital: Equity and Debt

![]()

Module 4 Real Estate and Infrastructure

![]()

Module 5 Natural Resources

![]()

Module 6 Hedge Funds

![]()

Module 7 Introduction to Digital Assets

![]()

4.Fixed Income

Module 1 Fixed-Income Instrument Features

![]()

Module 2 Fixed-Income Cash Flows and Types

![]()

Module 3 Fixed-Income Issuance and Trading

![]()

Module 4 Fixed-Income Markets for Corporate Issuers

![]()

Module 5 Fixed-Income Markets for Government Issuers

![]()

Module 6 Fixed-Income Bond Valuation: Prices and Yields

![]()

Module 7 Yield and Yield Spread Measures for Fixed-Rate Bonds

![]()

Module 8 Yield and Yield Spread Measures for Floating-Rate Instruments

![]()

Module 9 The Term Structure of Interest Rates: Spot, Par, and Forward Curves

![]()

Module 10 Interest Rate Risk and Return

![]()

Module 11 Yield-Based Bond Duration Measures and Properties

![]()

Module 12 Yield-Based Bond Convexity and Portfolio Properties

![]()

Module 13 Curve-Based and Empirical Fixed-Income Risk Measures

![]()

Module 14 Credit Risk

![]()

Module 15 Credit Analysis for Government Issuers

![]()

Module 16 Credit Analysis for Corporate Issuers

![]()

Module 17 Fixed-Income Securitization

![]()

Module 18 Asset-Backed Security (ABS) Instrument and Market Features

![]()

Module 19 Mortgage-Backed Security (MBS) Instrument and Market Features

![]()

5.Derivatives

Module 5 Pricing and Valuation of Forward Contracts and for an Underlying with Varying Maturities

![]()

Module 6 Pricing and Valuation of Futures Contracts

![]()

Module 7 Pricing and Valuation of Interest Rates and Other Swaps

![]()

Module 8 Pricing and Valuation of Options

![]()

Module 9 Option Replication Using Put–Call Parity

![]()

Module 4 Arbitrage, Replication, and the Cost of Carry in Pricing Derivatives

![]()

Module 3 Derivative Benefits, Risks, and Issuer and Investor Uses

![]()

Module 2 Forward Commitment and Contingent Claim Features and Instruments

![]()

Module 1 Derivative Instrument and Derivative Market Features

![]()

Module 10 Valuing a Derivative Using a One-Period Binomial Model

![]()

6.Equity Investments

Module 1 Market Organization and Structure

![]()

Module 2 Security Market Indices

![]()

Module 3 Market Efficiency

![]()

Module 4 Overview of Equity Securities

![]()

Module 5 Company Analysis: Past and Present

![]()

Module 6 Industry and Competitive Analysis

![]()

Module 7 Company Analysis: Forecasting

![]()

Module 8 Equity Valuation: Concept and Basic Tool

![]()

7.Financial Statement Analysis

Introduction

![]()

Module 1 Introduction to Financial Statement Analysis

![]()

Module 2 Analyzing Income Statements

![]()

Module 3 Analyzing Balance Sheets

![]()

Module 4 Analyzing Statements of Cash Flows I

![]()

Module 5 Analyzing Statements of Cash Flows II

![]()

Module 6 Analysis of Inventories

![]()

Module 7 Analysis of Long-Lived Assets

![]()

Module 8 Topics in Long-Term Liabilities and Equity

![]()

Module 9 Analysis of Income Taxes

![]()

Module 10 Financial Reporting Quality

![]()

Module 11 Financial Analysis Techniques

![]()

Module 12 Introduction to Financial Statement Modeling

![]()

8.Corporate Issuers

Module 1 Organizational Forms, Corporate Issuer Features, and Ownership

![]()

Module 2 Investors and Other Stakeholders

![]()

Module 3 Corporate Governance: Conflicts, Mechanisms, Risks, and Benefits

![]()

Module 4 Working Capital and Liquidity

![]()

Module 5 Capital Investments and Capital Allocation

![]()

Module 6 Capital Structure

![]()

Module 7 Business Models

![]()

9.Economics

Module 1 Firms and Market Structures

![]()

Module 2 Understanding Business Cycles

![]()

Module 3 Fiscal Policy

![]()

Module 4 Monetary Policy

![]()

Module 5 Introduction to Geopolitics

![]()

Module 6 International Trade

![]()

Module 7 Capital Flows and the FX Market

![]()

Module 8 Exchange Rate Calculations

![]()

10.Quantitative Methods

Module 1 Rates and Returns

![]()

Module 2 The Time Value of Money in Finance

![]()

Module 3 Statistical Measures of Asset Returns

![]()

Module 4 Probability Trees and Conditional Expectations

![]()

Module 5 Portfolio Mathematics

![]()

Module 6 Simulation Methods

![]()

Module 7 Estimation and Inference

![]()

Module 8 Hypothesis Testing

![]()

Module 9 Parametric and Non-Parametric Tests of Independence

![]()

Module 10 Simple Linear Regression

![]()

Module 11 Introduction to Big Data Techniques

![]()

1.小灶点睛班【202402期】

小灶点睛直播

![]()

2.小灶点睛班【202405期】

小灶点睛直播

![]()

3.小灶点晴班【202502期】

小灶点晴直播

![]()

4. 小灶点睛班【202505期】

小灶点晴直播

![]()

1.Ethical and Professional Standards

道德冲刺

![]()

2.Portfolio Management

组合管理冲刺

![]()

3.Alternative Investments

另类投资冲刺

![]()

4.Derivatives

衍生品冲刺

![]()

5.Fixed Income

固定收益冲刺

![]()

6.Equity Investments

权益投资冲刺

![]()

7.Financial Statement Analysis

财报冲刺

![]()

8.Corporate Issuers

企业发行人 冲刺

![]()

9.Economics

经济学冲刺

![]()

10.Quantitative Methods

数量冲刺

![]()