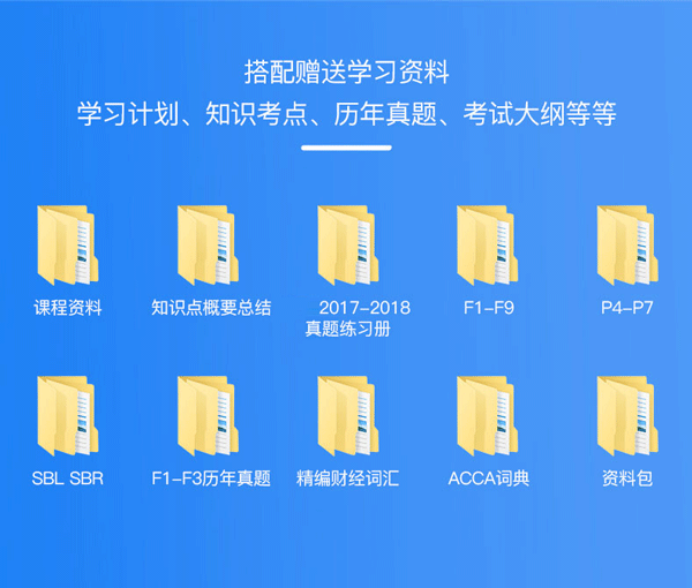

ACCA考试学员要学习的资料有很多,掌握ACCA考试的重难点也很关键。ACCA考试历年真题是学员必须要做的,了解考试的题型及要求,帮助学员更好的通过考试。

戳:“各科必背定义+历年真题中文解析+20年习题册(PDF版)”

3. [单选题]8 P and Q are in partnership, sharing profits in the ratio 2:1. On 1 July 2004 they admitted P’s son R as a partner. P

guaranteed that R’s profit share would not be less than $25,000 for the six months to 31 December 2004. The profitsharing arrangements after R’s admission were P 50%, Q 30%, R 20%. The profit for the year ended 31 December 2004 is $240,000, accruing evenly over the year. What should P’s final profit share be for the year ended 31 December 2004?

A. $140,000

B. $139,000

C. $114,000

D. $139,375

4. [单选题]A corporate taxpayer has under-reported its taxable revenue in 2002 and hence underpaid value added tax (VAT) and enterprise income tax (EIT). In 2014, the taxpayer was charged by the tax authority with committing an act of tax evasion in 2002.

A. Which of the following statements is correct?

B. The taxpayer must pay the additional taxes due, plus a late payment surcharge and a penalty

C. There is no need for the taxpayer to pay any additional taxes, late payment surcharge or penalty as the statute of limitation is ten years

D. The taxpayer must pay the additional taxes, but no late payment surcharge or penalty as the statute of limitation is ten years for late payment surcharge and penalties

E. The taxpayer must pay the additional taxes and a late payment surcharge but not a penalty as the statute of limitation is five years for penalties

5. [单选题]25 What should the minority interest figure be in the group’s consolidated balance sheet at 31 December 2005?

A. $240,000

B. $80,000

C. $180,000

D. $140,000

答案:

3、正确答案 :B

解析:80,000 + 60,000 – 1,000 = 139,000

4、正确答案 :E

解析:Per Article 86 of the Tax Collection and Administrative Law, the statute of limitation for an administrative penalty on non-compliances is five years.

5、正确答案 :A

解析:20% x (400,000 + 800,000)

备考ACCA考试中你是不是无从下手,也不知道该怎么备考,这不,这边为你准备了ACCA备考攻略和资料,有需要的在线咨询或者添加老师微信:rongyuejiaoyu

阅读排行

- 1 ACCA证书申请条件有哪些?ACCA证书申请流程

- 2 ACCA考生参加分季机考的注意事项

- 3 ACCA考试哪些城市有考点?

- 4 ACCA 2025全国大学生财智精英挑战赛报名仅剩12天!

- 5 上海市境外职业资格证书认可清单发布,涉及ACCA、CFA、CMA人才政策

- 6 3万元奖励!ACCA人才获郑州航空港经济综合实验区政策支持

- 7 《上海市境外职业资格证书认可清单(3.0版)》正式发布,FCCA及ACCA证书连续第三年入选!

- 8 ACCA伦敦大学专业会计学士学位(BSc)2026年3月入学批次现已开放申请

- 9 ACCA考试需要多少钱?ACCA考试难度大不大?

- 10 ACCA考试地点有哪些?ACCA考试内容有哪些?